Working from home may have started as a short-term response to the COVID crisis, but for many people, the last few months have changed how they’ll be working for the foreseeable future. Twitter was one of the first of a growing list of companies to announce that many of its employees would be able to continue working from home forever.

At the beginning of the lockdowns, there were plenty of challenges to overcome—full houses, bad internet, uncomfortable chairs—but the consensus among many people now is that they want to carry on working remotely even if lockdowns begin to ease.

If your workspace has permanently or temporarily relocated to your home, now may be a good time to find out whether you’re eligible to claim for expenses.

Who is eligible to claim for home workspace expenses?

There are currently two main criteria for claiming home office expenses:

- if more than half of your employment duties are carried out from your home

or

- if you use your home to meet with clients on a regular or continuous basis

Alongside this, your employment must require that you work from home — it can’t be an optional arrangement. At the moment, many businesses do require their employees to work remotely. However, it’s important to check your employee contract, the company’s work from home policy and your employee manual to make sure this remains the same, particularly as new policies and advice continue to emerge over the coming weeks and months.

Social distancing measures currently rule out any face-to-face meetings with clients. Unless the CRA includes virtual meetings in their criteria going forward, then it’s more likely you’ll instead need to qualify for expenses by completing more than 50% of your duties at home.

Current tax rules state that you can only deduct home office expenses if you were required to work from home for more than six months of the calendar year. As more and more businesses are allowed to return to their place of work, this may mean that many people will fall short of this six-month requirement. Hopefully, going forward, legislature will be put in place to accommodate the need for more flexibility in working from home.

What expenses can be claimed?

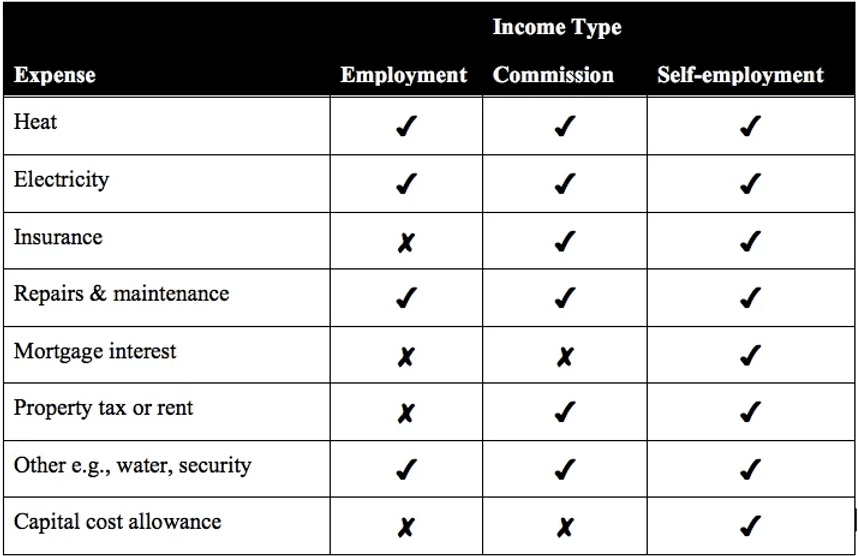

The different home office expenses you can claim depend on your income type:

The above-noted expenses are fairly self-explanatory, except for capital cost allowance, and repairs and maintenance.

Capital cost allowance lets you deduct the cost of purchases over several years. It’s an allowance for purchases with a depreciable value – that is to say, they’ll get worn out over several years of use. So, if you buy something for your home office, like a chair or a computer, you have to deduct the cost of it each year rather than claiming for the full cost amount upfront. This allowance is only for self-employed people. However, in light of COVID-19, the CRA is allowing employers to reimburse the costs of personal computer equipment up to $500 provided it allows the employee to “immediately and properly perform their work”. The amount isn’t considered a taxable benefit, but you must remember to keep hold of your receipt to provide when required.

You can only claim for repairs and maintenance that are related to the home office space, be it directly or indirectly. You can’t claim to redecorate your bedroom, for example, but you may be able to claim for minor repairs to your heating system as this indirectly affects your home workspace.

How do I calculate home office expenses?

To work out your home office expenses, you need to calculate what percentage of your overall costs are related to your home office. To do this, you need to determine the percentage of time that you use the space for your work, and what proportion of your home is made up by the workspace. The CRA provides one reasonable basis for calculating this proportion, which is by taking the total square footage of your home and dividing it by the total square footage of your home office. For example, let’s say you live in an 1800 square foot property, and your home office is 10 x 10 feet. 100 divided by 1800 = 5%. This indicates that 95% of your home usage is personal, and 5% is for business purposes. You can then apply this percentage to your allowable home expenses. Depending on your circumstances, however, there may be other reasonable ways to make these calculations.

If you are calculating your expenses on an annual basis, you should also take into account the proportion of the year spent working from home. To do this, you can prorate your expenses based on the number of months out of twelve spent working from home.

The maths for this can start to get a little complicated. The CPA Canada and Canadian Tax Foundation have asked the CRA to consider a more simplified approach, which would let employees claim home office expenses based on a fixed rate per hours worked.

What other employment expenses could I deduct?

You could consider asking your employer for reimbursement or allowances related to office supplies such as pens, pencils, ink cartridges, stamps and stationary, provided these are an essential part of your job. You could also consider long-distance phone calls and cellular minutes as a deductible as employee expenses, provided they were reasonably related to your duties. Your employer must be in agreement that the expenses were reasonably required for you to carry out your responsibilities.

Allowances and reimbursements from employers

Other than the new COVID-19 CRA scheme allowing $500 reimbursement for computer equipment, all other allowances are considered a taxable employment benefit. These should be reported on your T4 or T4A and included in your income.

If your employer directly reimburses you for reasonable expenses, then these do not need to be included in your income. However, if there’s the potential for personal use, then the portion related to this use should be included in your income as a taxable benefit.

You must keep a record of all receipts and invoices to support your home office expenses. Employers are required by the CRA to sign the T2200 Declaration of Conditions of Employment to support any claims from employees or commissioned salespersons. Although the Canadian Tax Foundation and CPA has requested the government to provide a more streamlined system, there has not yet been a response.

Can I claim for a GST/HST rebate?

If you are eligible to deduct home office expenses, you might also be able to claim a rebate for the following taxes paid on these expenses (based on the portion of yearly deductible expenses):

- The Goods and Services Tax (GST)

- The Harmonized Sales Tax (HST)

You will need to fill out a GST370 Employee form, as well as a Partner GST/HST Rebate Application alongside your personal income tax return. Any GST/HST rebate received must be included in your income for the year. Your employer must also be a GST/HST registrant, and cannot be a listed financial institution.

What’s the main takeaway?

Many people have been working from home and will continue to do so for the foreseeable future. To address this, it’s likely that the CRA will continue to release new changes to how, when and what people can claim for. Make sure you keep all of your receipts and invoices for purchases for heat, hydro, water, internet etc so that you can make the most of possible deductions in your 2020 income tax return.